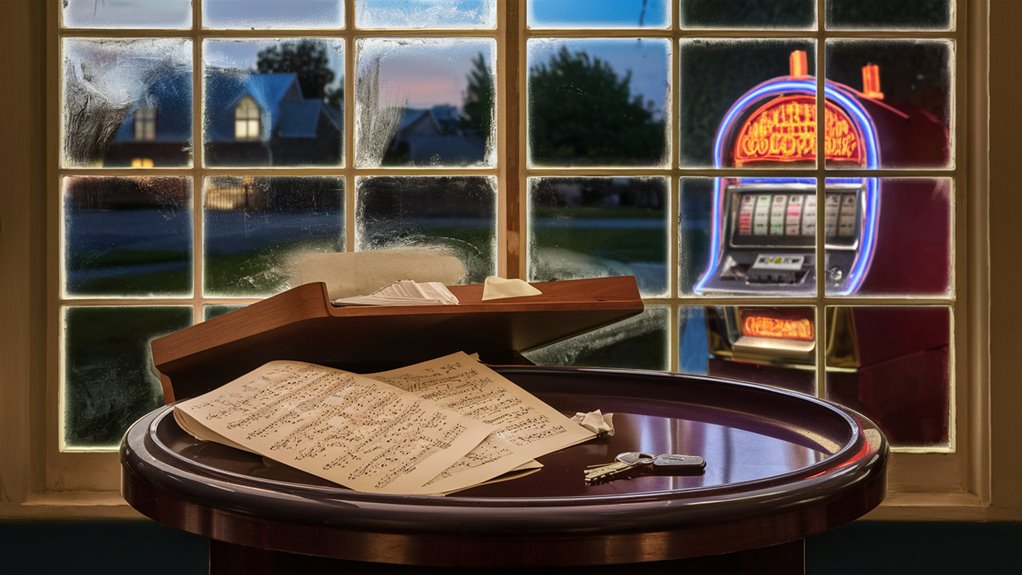

From Community Choir Director to Stealing Donations for Slot Machines

The Downfall of a Community Choir Director: A Cautionary Tale of Fraud and Addiction

Rise to Prominence and Achievement

The story begins with remarkable musical accomplishments, as the choir director built an exceptional 60-member ensemble that achieved the prestigious honor of performing at Carnegie Hall. Under her leadership, the choir successfully raised $2 million through benefit concerts and community events, establishing itself as a cornerstone of local cultural life.

The Descent into Financial Fraud

In 2019, the director's path took a dark turn when she began systematically embezzling funds from the organization. Through sophisticated manipulation of accounting software and the creation of fraudulent vendor accounts, she managed to misappropriate $247,832 over a three-year period, including $157,000 in church donations meant for community outreach and musical programs.

Gambling Addiction's Escalating Grip

The director's gambling addiction progressed rapidly from modest $20 wagers to increasingly risky behavior. Her addiction intensified to four casino visits per week, ultimately leading to a staggering $8,500 slot machine bet. This pattern of escalation reflected the classic progression of compulsive gambling behavior.

Devastating Community Impact

The revelation of this betrayal had far-reaching consequences:

- 40% decline in choir attendance

- Severe fracturing of congregation trust

- Implementation of stringent financial oversight measures

- Long-lasting damage to community bonds

The case serves as a powerful reminder of the importance of financial accountability and the devastating impact of unchecked addiction in community organizations.

A Pillar of the Community

A Pillar of the Community: Richard Thorne's Musical Legacy

Distinguished Leadership and Artistic Excellence

Richard Thorne transformed the Millbrook Community Choir over two remarkable decades, elevating a modest church ensemble into a prestigious 60-member performing group.

Under his direction, the choir achieved regional recognition and secured multiple competition victories, establishing performances at world-class venues including Carnegie Hall and the Kennedy Center.

Community Impact and Charitable Contributions

His influence resonated far beyond musical achievements. Through strategic organization of annual benefit concerts, Thorne generated over $2 million for local charitable initiatives.

His establishment of a youth music scholarship program and dedicated weekly involvement in senior center music therapy sessions demonstrated his commitment to musical education and healing across generations.

Cultural Development and Artistic Legacy

The creation of Millbrook's summer music festival in 2005 stands as a testament to Thorne's vision for community cultural enrichment.

His leadership extended to key positions on the Arts Council and Community Foundation boards, where he directed the cultural enrichment committee.

Through these roles, he championed emerging artists and established the beloved Christmas concert tradition that annually draws thousands to Millbrook's town square. His mentorship has launched numerous professional music careers, creating a lasting impact on the regional arts community.

Professional Achievements

- Regional competition victories

- Carnegie Hall performances

- Kennedy Center appearances

- $2 million raised for charity

- Cultural enrichment leadership

- Music education advocacy

The First Signs of Trouble

The First Signs of Financial Misconduct

Initial Discovery of Discrepancies

Financial irregularities emerged in late 2019 when board treasurer Sarah Chen identified concerning disparities between reported concert revenues and actual bank deposits, casting doubt on Richard Thorne's previously unblemished reputation.

Detailed Audit Findings

The preliminary audit exposed missing funds totaling $12,450 from three major performances between September and November 2019.

While deposit documentation submitted by Thorne reflected complete amounts, banking records revealed substantially reduced deposits. When confronted with these financial discrepancies, Thorne attributed the issue to administrative errors and committed to resolving the situation.

Escalating Evidence

Suspicious transactions continued to surface as investigators uncovered multiple checks written to cash from the choir's account, purportedly for operational expenses like sheet music and venue rentals.

The absence of corresponding documentation raised serious concerns. By December 2019, choir members began reporting unrecorded personal check payments for music fees submitted directly to Thorne.

Critical Financial Discovery

The situation reached a critical point during the January 2020 tax preparation period. Chen's comprehensive financial review revealed the true scope of the misappropriation: over $47,000 in unauthorized withdrawals from choir accounts throughout 2019, demonstrating a systematic pattern of financial misconduct.

#

Behind the Financial Facade

# Behind the Financial Facade

Uncovering Systematic Financial Fraud

The seemingly isolated financial discrepancies revealed a sophisticated deception scheme orchestrated by Richard Thorne over multiple years.

Through advanced manipulation of choir accounting software, Thorne engineered a complex system of fraudulent vendor payments, while systematically diverting funds to personal accounts.

The scheme incorporated fabricated documentation for nonexistent expenses including sheet music, venue rentals, and equipment purchases.

Shell Companies and Transaction Patterns

The investigation exposed a network of shell companies strategically named to mirror legitimate music industry suppliers.

Thorne executed biweekly payments ranging from $500 to $3,000, deliberately maintaining transactions below secondary approval thresholds.

Bank transaction records traced withdrawals to ATMs proximate to the Golden Gates Casino, where substantial time was spent at gaming machines.

Financial Impact and Oversight Failure

The total embezzlement reached $247,832 across a three-year period, significantly impacting both the choir's operational budget and its scholarship fund designed for underprivileged youth.

Despite the presence of professional oversight, including reviews by a retired accountant treasurer, the sophisticated nature of the financial fraud scheme successfully evaded detection during standard financial audits.

The Casino's Magnetic Pull

The Casino's Magnetic Pull: A Case Study in Gambling Addiction

The Initial Descent

Golden Gates Casino's hypnotic atmosphere of flashing lights and pulsing energy became Richard Thorne's sanctuary from mounting financial pressures.

His gambling pattern analysis reveals a March 2021 debut with conservative $20-30 bets, rapidly escalating to four nightly sessions weekly by June, extending until 3 AM despite morning commitments.

Behavioral Patterns and Escalation

Security surveillance documented Thorne's ritualistic behavior, consistently gravitating toward specific slot machines near the north entrance.

Financial tracking exposed an alarming progression of losses: $2,300 in July, $4,800 in August, culminating in a devastating $11,600 in September.

His cash deposits suspiciously aligned with missing choir donation records.

The Breaking Point

Casino staff interviews paint a portrait of a desperate gambler showing classic addiction indicators – increasingly agitated behavior, persistent credit requests, and delusional beliefs in imminent winning streaks.

The situation reached its climax on October 12th, when Thorne wagered $8,500 in misappropriated choir funds, marking his final documented casino visit before the theft discovery.

The Truth Comes Out

Financial Fraud Uncovered at Local Choir Organization

Initial Discovery of Embezzlement

Sarah Martinez, the choir treasurer, identified concerning financial irregularities during a routine bank statement reconciliation on October 15th, 2021.

A thorough examination of six months' worth of transactions revealed $47,500 in unauthorized withdrawals from the organization's donation account.

Casino Connection and Evidence Trail

Investigation traced the withdrawals to Golden Gates Casino ATMs, where security footage captured choir director Thomas Wilson making multiple cash withdrawals using the organization's debit card.

When the choir board confronted Wilson, he admitted to embezzling funds to fuel a gambling addiction that intensified during the pandemic period.

Fraudulent Financial Activities

The financial investigation exposed Wilson's systematic fraud dating back to March 2021. His methods included:

- Falsifying financial reports

- Inflating administrative expenses

- Understating donation amounts

- Intercepting and altering bank statements

- Manipulating digital financial records

Legal Consequences

Wilson's immediate resignation came with an agreement for full restitution. The choir filed formal charges, leading to his arrest on October 22nd.

He faces serious criminal charges:

- Three felony counts of theft

- One count of tampering with financial records

The case is set for trial in March 2023, marking a significant legal proceeding in organizational fraud prosecution.

Shattered Trust and Broken Bonds

The Impact of Betrayal on Church Communities

Trust Violation in Religious Organizations

The devastating impact of financial misconduct sent shockwaves through the church choir community, permanently altering relationships built over generations.

Long-term donors who'd contributed faithfully for decades were forced to question every historical transaction, as evidence emerged that their donations may have fueled a gambling addiction rather than supporting intended ministry purposes.

Psychological and Social Fallout

The breach of trust penetrated far deeper than financial matters.

Confidential counseling sessions became weapons of manipulation, with personal vulnerabilities exploited to secure additional contributions.

The church community fabric began unraveling as interpersonal relationships fractured between those defending Wilson's past contributions and advocates demanding complete transparency.

Long-Term Organizational Damage

A thorough church board investigation uncovered three years of falsified financial records masked by elaborate deceptions.

The choir ministry experienced a devastating 40% attendance decline within two months of the revelations.

The departure of founding members created a leadership vacuum, citing an irreparable breach of trust. These fractured community bonds represent a critical challenge to the organization's future stability and growth potential.

Moving Forward After Betrayal

Moving Forward After Financial Betrayal: A Church Recovery Guide

Understanding the Impact of Financial Misconduct

The discovery of $157,000 embezzled from church donations creates devastating ripples throughout a faith community.

Such betrayals strike at the heart of congregational trust and require systematic intervention for genuine healing to occur.

Implementing Financial Safeguards

Enhanced Oversight Measures

- Three-member rotating financial committee conducting monthly audits

- Dual signature requirements for transactions exceeding $500

- Security camera installation in counting areas

- Quarterly CPA reviews of financial records

Professional Support Systems

- Weekly support group sessions for emotional recovery

- Partnership with certified counseling services

- Enhanced background screening for leadership positions

- Strict hiring protocols for all staff members

Building a Stronger Foundation

The path to restoration demands both structural changes and emotional healing.

Through professional guidance, transparent processes, and strengthened accountability measures, congregations can rebuild trust and establish stronger protections for their community's resources.

Long-term Protection Strategies

Effective recovery combines rigorous financial controls with dedicated healing support.

This comprehensive approach ensures both practical safeguards and emotional restoration, creating a more resilient church community prepared to move forward while maintaining vigilant oversight of sacred resources.